Pay-it-forward founders have a lot to teach us–not just about startups but also about handling the chaos and mental toll of starting a business. Through his books and podcast, Startups for the Rest of Us, my guest on today’s show, Rob Walling, has created a supportive, mentoring entrepreneurial community. I’m happy to welcome him to the show today.

As a serial entrepreneur who has founded six companies, authored four books on entrepreneurship, and invested in over 190 startups, Rob brings knowledge to the table. In this episode, he shares insights on developing a “founder’s gut” – the intuition that guides critical business decisions. Rob discusses the importance of balancing persistence with the ability to pivot and how to recognize when it’s time to quit a failing venture.

Our conversation explores the value of personality assessments in understanding oneself and building effective teams. Rob also reveals how he leveraged AI to streamline the creation of his latest course, SaaS Launchpad, potentially saving hundreds of hours. Whether you’re a seasoned entrepreneur or just starting, this discussion offers valuable lessons on navigating the startup landscape and making decisions that can propel your business forward. So without any further ado, on with the show!

In This Episode

- [02:26] Rob Walling recounts his journey, starting as a construction worker before realizing he wanted a different direction, which led him to learn programming and ultimately become a software consultant.

- [07:38] Rob reflects on the challenges of his early career and how those experiences have deepened his gratitude for his current success.

- [09:11] Rob explores the concept of success in startups, highlighting the powerful combination of a strong founder and a favorable market.

- [15:25] Rob underscores the value of asking insightful questions during interviews to gauge a founder’s coachability and openness to feedback.

- [21:59] Rob uncovers a key trait of a coachable founder.

- [34:48] Stephan and Rob delve into personality assessments, including the Kolbe assessment, StrengthsFinder, Enneagram, and Myers-Briggs.

- [45:04] Rob shares how AI was instrumental in creating his latest course, SaaS Launchpad, significantly streamlining the production process.

- [47:43] Rob explains his decision to launch his book Exit Strategy through Kickstarter and the advantages of using this platform.

- [50:33] Rob provides details on how to contact him.

Rob, it’s so great to have you on the show.

Thanks so much for having me. It’s my pleasure.

Yeah. So I know we must do the obligatory origin story, but you have a superhero origin story. We got to get it out there for my audience to experience secondhand how we went on that hero’s journey. It’s incredible what you’ve accomplished.

Yeah. Thank you for that. It’s been quite a journey. To be honest, I have a flashback to this moment 25 or 26 years ago when I was a construction worker. It was raining, there was a backhoe, and we were digging a ditch. I was digging a ditch. And I thought to myself, where did I go wrong? This is not what I want to be doing with my life. I had gone to college, and I was going to be kind of an electrical engineer or an electrician or something in that field. That’s why my dad worked in construction for 40 years, and my brother’s in the trade.

It was just the path I was going to take. I was like, this is not for me. I don’t want to live the rest of my life like this. So, I started going nights and weekends to the library to check out books on programming. I had learned how to code when I was a kid in the eighties, but I didn’t really know you could make a living at it. It was just this whole mysterious thing. The web was just coming around, and I was like,” I’m going to learn PHP, Perl, and HTML.’ And I did.

I wound up getting a job as a programmer at a dot-com company. That was when I realized I wanted to do this for the rest of my life. Like, I love tech and computers and software. I grew up in the Bay area, in the East Bay, like the worldwide hub of tech, and nobody I knew was a tech. It was all just everybody, a construction worker or a service worker. So that led me to write a lot of software.

I became a consultant and started realizing, do I want to be dollars for hours my entire life? And that was the next iteration, about four or five years later, if you can. I think I might be able to build software products that could make money while I sleep. Put it in quotes. No one else I knew was doing this. I mean, this is 2005, right? And this is like Basecamp. Either didn’t exist, or I’d never heard of them. At that point, Mailchimp was barely heard of. Salesforce was really the only SaaS, but I wasn’t going to build Salesforce.

I was one person working nights and weekends while I had a day job. So ultimately, I started building products, and eventually, within three years of that, probably two or eight, I think, I basically quit the day job. I had enough income, about $150,000 a year, from products. I had several different products. And that was an absolutely life-changing moment. The moment that I just said, no more consulting. I won’t work for anyone ever again.

I just remember going to Barnes and Noble, there was a coffee shop, and sitting there and drinking coffee and thinking, I don’t have to do anything; I have to maintain my stuff. But it was the first day, a non-vacation day, of my entire adult life that I was like, “I’m now in control.”

1% of startups should raise ventures, 9% should seek angel funding, and 90% should bootstrap. Share on XYeah, amazing. What did you get as the epiphany, lesson, or insight as to taking that secret route, digging ditches, and being a construction worker to get to where you were? Because there’s a gift in that. You could have just easily walked into a startup initially and skipped that whole thing, but it served you for whatever reason. I’m curious to hear what you see from that as the benefit.

Yeah, it really is an interesting question, isn’t it? Because I don’t know why I didn’t just go work for a startup. It just never occurred to me that that would be the case; I didn’t know anyone who worked for startups. I just didn’t know that world. And so for me, it was like, how can I make money doing this? Then, the next step is, how can I own what makes me money? I want equity. I want to build something in the long term. It killed me to even dollars for hours.

At a certain point, I was charging $125 an hour as a developer, so I was making like $200,000 a year as a 30-year-old. And this is 20 years ago, right? So, like, it was a lot of money, and yet I was super unhappy, super unhappy.

And that really clicked with me. I mean, look, I made $4.50 an hour in my first job. Like my dad was a construction worker, my mom was a receptionist. For me to make $200,000 in whatever, 1999 or no, I guess it was later, 2004 money.

It was just like I had never seen that much money, and yet I was unhappy because it was how I built something that was a long-term asset. How do I find freedom? I wanted three things. I wanted the freedom to work on what I wanted to do, interesting things, and purpose because I wanted to, again, have something that’s driving me, that’s super interesting, and relationships. That’s the third one, which has always been why I’ve mostly bootstrapped.

I’ve started six companies. Five of them were bootstrapped rather than. I never went and raised venture funding because I didn’t want to have to work the 70-hour-a-week treadmill, as some folks do.

I wanted freedom to work on interesting things, a sense of purpose, and meaningful relationships.

Yeah, but do you see that there was a value in that contrast of having the unhappiness, having the $4.50 an hour, and working your way into something that should have been fulfilling but still wasn’t so that you could appreciate what you have now? Or do you think that maybe that was unnecessary?

Probably was necessary for me.

I know existential questions here, but I’m curious.

I mean, I wished it had been a lot easier. I wish it was easier for many people who go down this path. I’ve worked with thousands of entrepreneurs over the past 20 years, and I don’t know if the struggle always occurs. The struggle is worth it a lot of the time, I think because it makes you thankful. But some of those years of struggle I wished I hadn’t experienced. But these days, it makes me extremely grateful for anything I have. And it taught me. Here’s the thing. I run two multimillion-dollar companies simultaneously.

I write a book every 18 months. Like I do a bunch of. So someone might say, “wow, you really put a lot of stuff.” The skills that I have to do. That is all that I learned back then, like being extremely efficient with my time because I had to be, being extremely capital efficient because I had to be just pushing, persevering, and generally working on the right things. Because if I didn’t work on the right things, nothing happened.

These skills were really a baptism of fire, and I couldn’t be successful without them. Those now allow me to level up to where I’m able to kind of, I think, live the professional life I want, where I do have freedom, but I also have a purpose: Running these two companies, Microconf and TinySeed.

Yeah, well, startup founders are known as scrappy, resilient hackers, kind of growth hackers, computer coding hackers and so forth, and they are always looking for ways to innovate and improvise and turn something from a thought into a thing with very few resources. That’s pretty awesome. So it’s a great skill set to have earned over those 20-some years.

Yeah, I do see some founders who raise a lot of money early because that’s the script, right? In my world of startups, it’s like, don’t you just create a business plan and then raise a bunch of money? Or create an MVP and raise a bunch of money? And that shouldn’t be the script. That should be the script for about 1% of companies.

I think the other 9%, which I have this 1-9-90 rule, I call 1%, should probably raise venture 9% of startups, should probably raise some type of angel funding or independent funding. That’s what my accelerator is: a TinySeed. And about 90%, I think, should just bootstrap. The mistake I see in some founders, especially young founders, or I shouldn’t even see, is that it’s not an age thing; it’s an experience. First-time founders are, well, I got to raise a lot of money. And then they raise a bunch of money.

I have $500,000 or a million in the bank, but they don’t have any skills to run a startup, so they don’t know what they’re doing. These burn through the money; having too much money without an efficient mindset is a real problem. I’ve seen multiple founders raise millions and churn through it with nothing to show. So there’s a danger there. But bootstrappers are exactly what you’re talking about.

Yeah. So, a mutual friend, Rand Fishkin, had a very difficult kind of trial-by-fire situation with his VC experience, and he wrote a book about it. Did you know that Rand and I co-authored The Art of SEO together? He was a part of the first two editions.

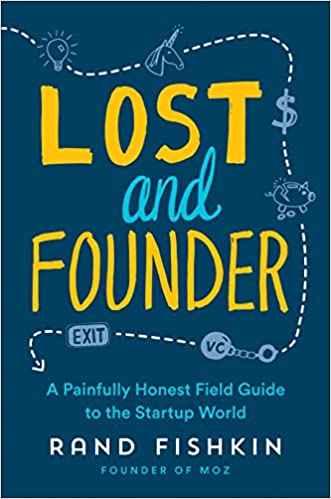

I didn’t know that. I have read his other book, Lost and Founder, for sure. He and I have known each other for several years. I’m invested in his company, and he just spoke at Microconf a few months ago, so that’s great. He had a whole experience.

If folks are listening to this and haven’t read Lost and Founder, and you want to hear the trials and tribulations of raising a venture and not having it go well, he’s very transparent and well-written. The story’s well told. It’s highly recommended for an audible or physical copy.

Yep. Also, we had an episode on my other podcast talk about this, so I had a podcast about personal development, and he spoke about that experience. Of course, we’ve been talking about, over multiple episodes on this show, things like SEO and social media and his amazing toolset for finding audiences and things like that, learning what they’re interested in.

Anyways, so I digress. He’s awesome. I think it’s an incredible resilience builder. Regardless of whether you take the money, if it’s angel funding, or it’s VC money, or you bootstrap it and get really scrappy either way, you’re going to learn some incredible lessons along the way. What would you say is the best lesson that you’ve gotten through either your own experiences or kind of curiously living through some of your investments and those startup founders and what they’ve experienced or perhaps somebody in your community? I know you have a community of startup founders that you serve with your SaaS, launchpad and podcast startups for the rest of us.

So, I’m curious to hear what pops into your mind.

I’ve been thinking a lot about the big lesson lately: this idea of success, like in a startup. I know that most of your audience is not startup founders per se, but they are potential business owners. Any type of venture that you’re going to launch. I’ve been looking at success factors because I’m invested in almost 200 companies, so I’m involved with 300. It’s a huge number, 300 founders.What caused the success isn’t one factor, and it’s never; some people say it’s the market.

You have to pick a big market. And it’s not just the market because I see strong markets, strong ideas, and execution with a founder who just isn’t coachable and doesn’t execute well. I’ve been really toying with the idea and talking about it lately. It’s a multiplier of your founder times in the market, and the market is like the whole market opportunity. There’s a bunch of market as a text expander into a bunch of bullets. But you get the idea that a founder is coachable and they execute really well. They generally work on the right things, and they get a lot of things done.

Developing good gut instincts is about making numerous hard decisions over time and learning from each of those experiences. Share on XThat founder can pick a poor market that’s small and not growing and has big incumbents, and they will just grind and not get very far. I’m not saying they won’t be successful, but they’ll have just minimal success and flipping it.

You have a founder who doesn’t know what they’re doing, and it’s an amazing market, but they hit it just at the right time. They launched a crypto startup in 2016 or AI in 2021. Do you know what I mean? And so you can have a one and a ten, and those multiply, and then you get a ten or a one and a ten, you get a ten.

But now, if you have that great founder and this incredible market and a little bit of luck and timing, ten times ten is 100, and it’s that big. It’s a logarithmic difference. So someone listening to this is like, “Okay, I’m not a startup founder. Why does this matter?” Well, a couple of things. Be careful about the markets you choose. Be wise about them.

Is the market large? Is it growing? Is it something that you have some type of edge in? Do you have any advantage? And number two, look at yourself as whether you’re an employee, marketer, consultant, founder, however, you identify how you can improve your traits, your abilities to execute, your coachability, do you have anyone that you’re around, whether you’re in a mastermind group, an advisor, a boss, a former colleague, just anyone who is better at you than most of the things you do.

I have a handful of people, and each of them is way better than me at a particular skill. Let’s say it’s like sales or deal-making; I’m just not very good at that. So my co-founder is, and I can go to him about a bunch of stuff, and then I have this other friend who’s just really smart, a startup founder, a deep thinker, asks the right questions and tends to make really good decisions. So when I have a very hard decision, I will go to him and ask the questions to get me to the right one.

Do you know what I mean? It’s not a board of advisory or whatever, but you get the idea. The folks around me are making me a better entrepreneur every day. So, kind of leave your audience with it, it’s like market times founder. How can you pick a good market, and how can you improve yourself as a founder or, you know, a marketer?

Do you have situations where you’ve invested and the founder is not coachable, or the founder is not taking the correct path as you see it? What do you do in that situation?

I give my best advice, and I’m a minority; we are a minority owner, so I say, “Look, this is what I would do. I feel very strongly about this. I’ve been an entrepreneur for 20 years, launched 6 companies, and invested 190. This is my advice to you.” And if some founders are really good and take that advice and do something slightly different, they factor it in, at least integrate it with their own lens, and then they’ll take on it. Some founders have already made up their minds about what they’re going to do, and they will ask me and other, I’d say, knowledgeable people; they’ll ask another investor and advisor this and that, and we all weigh in. Then they go off and do the first thing they want anyway. Right? So that’s what you’re talking about: a complete lack of coachability. I don’t know.

It’s not like I’m not invested in one startup. If I was invested in one or as my co-founder, it would be a real problem because I’d be like, you’re going to kill this startup. Like, this is our whole thing. I have 191. So if they make that choice, that’s up to them. I can’t make someone coachable who’s not coachable. I don’t even try. We try not to fund people who aren’t coachable, to be honest.

It’s certainly a vast minority of founders I work with who don’t at least heed, again, you don’t have to do what I say. I don’t know everything. I often couch that with, I’ll say, like, “I’m 80% certain of the advice I’m about to give you. In your shoes, I would do this.” Sometimes I’ll say, “Look, I’m 50-50. Here are your three, four, and five options. And these are kind of the top two for me.” And other times, I’m like, “It is obvious what you should do.” 100% raise you, or, you know, 98%. This is what I would do. And so I let people run with it.

The success of a startup depends both on the qualities of the founder and the attributes of the market. Careful market selection and continuous self-improvement are key. Share on XHow do you screen your potential startup investments to ensure coachability? Like, are you having them tell you their Kolbe scores? Are you giving them personality assessments to take beforehand? Some sort of interview process? You have some trick questions in there. What do you do?

Trick questions? That’s funny. How would you move Mount Fuji? I ask everyone, no, with nothing but a shovel and a wheelbarrow. We fund in batches, about 25 companies at a time. So we do an application. It’s like a Y combinator, folks. We’re an accelerator called TinySeeds for B2B SaaS.

So we get hundreds of applicants over two weeks and then whittle it down just based on the application. Then, my team does 70 or 80 Zoom interviews, and then about half of those make it down to my co-founder and I. There are no trick questions. Usually, I’m asking you questions about your business. “Oh, so I don’t understand this part. Why is your churn higher than I think it should be? Why is that?” I ask them very tactfully, but I ask hard questions. Your growth, I’m guessing you would prefer to be growing faster.

So I could say your growth sucks. This is shit business. Or I could say you’d prefer to be growing faster. Tell me why that is. So I get them to tell me. You can tell a lot about someone by how they answer these questions. If someone takes offense at my tactful phrasing of, “Hey, I think your churn’s a little high. Why is that?” You start to pick up. This person has a little thin skin. I wonder if this person will take advice. You. Often, towards the end of a call, there’s usually something about the business that either my co-founder or I feel off because we’ve seen so many. We’ve seen thousands and thousands of applicants. Again, hundreds and hundreds of interviews. There are patterns you see, so often, it’s like their pricing.

There’s something off with the pricing; there’s something off with the marketing. Their headline on their website is like, “I don’t know what you do. It just took you four minutes to explain.” Like, I know B2B SaaS in the world. I’m one of the top, I don’t know, 50-100. I don’t know. There’s not that many people who know it as much as I do. And it took you five minutes to explain what you do? That’s a problem, right? So then we’ll bounce back and forth, and I’ll say, “Hey, let’s workshop something that shows you coachability.”

Like are they willing to have that conversation, or are they defensive? Are they like, no, no, no, this headline works. You don’t understand. Or, my pricing is really good. You don’t understand it. Like, all right, it’s a signal. That’s kind of how it is.

Being a marketer and learning to live with uncertainty while making tough decisions with incomplete information is extremely valuable.

You were joking about the trick questions and the riddles and all that. I’ll share one with you. I’ll give credit to Sam Czertok for sharing this with me. I love it. I use this one in interviews with job applicants. So,if a job applicant listens to this interview now, they know the secret sauce for this question. I’ll tell you what this test is called afterward because it’ll give it away.

So you’d ask, what’s the most important attribute you think will put you in a leadership position or help your company succeed? Or if it’s a job applicant, that’s the most important aspect or attribute for this particular position. Here are the five attributes.

Oh, and you give. Okay, yeah, give them to me. I’ll pick one.

These can be like. You can put whatever in here. I’ll just make some up. Creativity, technical acumen, attention to detail, honesty and dedication. Which of those five, pick one that is most crucial for, can we say?

Startup, founder, success or something?

Just, yeah.

Yeah. Can we do it?.

Or for your market, your business, or this position.

There’s no one. There isn’t one. Because any of them being taken to either extreme is a weakness. It’s like dedication. Not having any means, you’ll just flitter away and not stick with anything. Too much dedication means you’ll perseverate and work on the wrong things for too long when you should cut bait. So, I will accept and answer the question’s premise in a second.

But that’s the real answer: there is no one thing. Yep. But I dedicate one.

Which are you going to pick, Rob?

Dedication. Yeah.

Okay. So, this question is called the honesty test. So, if anyone answers the question with anything but honesty, they just failed the test. Because you can’t coach or teach somebody honesty. That is an ingrained value or attribute. They can learn to be more attentive to detail. They can learn to be more creative. You can take workshops.

You can send them to improv classes. You can’t send them to honesty classes. I don’t want to have to watch their screen while they’re working. I don’t want to worry that they’re cutting corners in ways that are out of integrity. So that’s why I love this question because it really gives me a sense of their character and how they answer it.

So if they answer attention to detail because I’m hiring them for a VA position, then I know they’re probably saying that because they think that I want to hear that instead of saying, “Well, you know what? I grew up with this value of honesty. I don’t cut corners; I don’t lie.” And so that’s why I pick honesty. I’m like, yes.

Marketing is not an if-then-else statement.

Then, I view honesty as a prerequisite for everything, I guess. And that’s where I say, picking one. It’s like a really honest founder. If I’m saying, like, what is a start? You know, what is going to lead to startup success? Being really honest will not lead to it; it is a fundamental thing that I want to invest in honest founders, but that’s not a skill that will lead to success. So it’s kind of a weird framing of it. But I totally, I hear you.

But for a position like hiring, let’s say, a VP or even an executive assistant or something, I would want that person to be honest, number one anyway. So, that was just an example of a trick question. There are plenty of others, but I thought I’d share that one I loved with you. So, how do you follow your gut? How do you make this part of your process so that you don’t get screwed over with a bad investment or being snookered by one of your founders or whatever? Not that they would do that, but you rely on your gut a lot. Something feels off, you said earlier. So, do you have a process or some sort of system? Have you documented, or can you articulate that intuition that you have?

It’s a really good question. it goes beyond just choosing investments and investing. 80% of being an entrepreneur is making hard decisions with incomplete information. To do that, you have to develop what I call the founder gut. The founders I see succeeding have pretty good instincts. My instincts used to be crap. They were garbage in terms of what to work on. I learned them over years of making mistakes and of being around people with better founder guts than I have.

And so, as a software developer, I didn’t need a lot of gut feeling. It’s a left-brain skill, and I could write the code, and the code worked, and I didn’t write bugs into my code. I realized that to be an entrepreneur, I needed to become a marketer. I had to learn marketing, which was considered black art among my friends. Oh, no, you’re reading marketing books. The Dark Side, right? That was just this big joke because developers, right?,

Developers are going to say that by the time, you know, I was a year or two into being a developer slash marketer, I realized, I need to use a ton of gut feel in this because marketing is not, I still do it as a left brain. I track the numbers and all this, not cut and dry. It’s not an if then else statement, you know, this, it’s, it’s like my gut feel is that this approach will work.

So I’m going to do that first, and it may not. And if it doesn’t, I’ll do the next experiment and give it. I’ll be dedicated, persevere on it long enough, and then switch it up. So, I think that being a marketer and learning how to live with that uncertainty and make hard decisions with incomplete information is extremely valuable.

That translates to me now as an entrepreneur. In every hiring decision I make, we just make a year-long projection, and we’re going to launch these products, this course, this effort. How did we get to that? I have a gut feeling that it’ll work. And if we look back to the last 20 years, enough of my things have worked. Not everything. I’ve shut things down. I’ve had failures, but enough of them. You don’t need 90% of them to work.

Some of the best tennis players, I don’t know if you’ve seen this. I think it was Pete Sampras who said, I am one of the winningest tennis players of all time and thousands of matches, and I’ve won 80% of my matches or some crazy number. He asked how many points I had won across all those games. 54% of the points. He won over all the major league baseball players in the world, right? They hit 300, 350 and 400. Like, it’s not that much of a success. As a startup founder or marketer, you know, you don’t need to be right. Even 90% of the time.

Some numbers are higher than 50 and lower than 90, and if you have that many successes, you will have an incredibly successful career. So that’s how I view it. I make hard decisions with incomplete information based on my founder’s gut.

I no longer make decisions alone; I always have a mastermind, co-founder, or advisor to help.

Here’s the other thing. I don’t make them alone anymore. I always have people around me, whether it’s a mastermind, co-founder, advisor, or whatever, to help those I trust. They are also smart and have good guts to navigate it. It’s like most of the way there with this thinking, but the name is off. Are you sure? Do you want to position that way? Someone else can check my stuff.

To answer your original question about how we evaluate founders, We have an Standard Operating Procedure (SOP). There are at least three of us. Talk to any given founder, and we do have, I call them, yellow flags. There are yellow flags, and there are red flags. Over time, it’s like anything putting in reps. Repetition helps you learn and train your brain to recognize when things feel off. And then we have due diligence. We have legal, due diligence; we check all their. You know what I mean? So, there are safeguards in place.

The law of large numbers implies we have probably already been completely scammed, and we just don’t know it yet because we’ve invested in that 100. We’re almost at 200 companies. Someone has to have totally taken our money and screwed us. I guess we’ll find out at some point, but that is where we’re making a lot of bets. This is what I tell people: you may not be able to invest in 200 startups, but you can do a lot of things quickly and at high quality if you are making a lot of bets. So, if I’m a marketer, I want to try two things simultaneously, maybe three. One of them might work out as long as I can focus.

If I am an entrepreneur within my business, I’m not saying you should launch five businesses because that doesn’t work, but within that business, am I shipping stuff every day that allows me, “Hey, as long as most of these work, I’m going to move forward. That’s how I view it.”

Yeah, it’s a series of bets, but it’s also, I think, tuning into that universal Google, the infinite intelligence. Do you sense that, or is the gut just a feeling? I’m curious how that lands for you.

As a founder or marketer, you don’t need to be right 90% of the time.

Yeah, the gut is a feeling that develops over time as you make more hard decisions. I remember making hard decisions in my, you know, let’s say, 20 years ago, and I just had no idea; I didn’t even know how to think about it. These days, founders come to me. Half of my job is as a founder, an entrepreneur coming to me and saying, I’m at a crossroads, and this is a really difficult decision that I have to make mostly right. I’m going to completely revamp my pricing; I’m going to hire, make an executive hire; I’m going to fire part of my team; I’m going to make a huge investment in marketing. How do I think about this? And usually, now I have a thought process. It’s like, well, here you’re, let’s just walk through all the options. Let’s brainstorm and write them all down, and then talk about the different avenues and approaches you could use.

Let’s talk about the upside and the downside. Everything has a downside. If it doesn’t work, what I want, with almost any decision I’m making, is an asymmetric upside. This means that I want that upside to be 10x or 100x. What the downside is. And that goes from, I don’t know, investing in startups, but it also goes with, like, if this marketing approach works, you’re a multimillion-dollar business in the next two years. So, this is worth investing in XYZ. And if it doesn’t work, you’re only out $50,000, only in quotes.

But that’s what you’re in six months of your life. So that’s how. That’s it, right? It’s a thought process of being pretty, pragmatic and trying to. A big mistake folks make is they don’t get creative enough in that original brainstorming. Suppose you have a big decision to make. I used to falsely dichotomize everything. Well, it’s this or that.

I can only do these two things. I can either start it or not, and that’s usually not the case. Usually, there are five or six solutions or ideas if you are very creative with them.

Yeah, I remember Tony Robbins saying this. I’m going to paraphrase, but if there are only two choices, that’s a dilemma. That’s not a choice; that’s a dilemma. And there are no dilemmas. There are always more than two choices. So, that’s a rough paraphrase, but I like that way of thinking and framing things. You mentioned the word bets earlier, so I feel you like this book. Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts

Yeah.

That’s her best book.

For somebody unfamiliar with the book, what’s the premise, and what’s the punchline or the biggest takeaway from that book?

I mean, the premise is that everything in life can be thought of as a bet. She’s a professional poker player and super successful. Right. There is always this mix of numbers, mathematics, and how to evaluate hard decisions with incomplete information. That’s a perfect example of it, right? I’m going to be honest; I haven’t read that book in 15 years. I don’t remember. What is a big takeaway? Enlighten us.

I don’t know. I haven’t read it, but I’ve heard of the book, and I just knew when you were talking about that book must be important to you, or the premise or the idea of thinking in terms of bets is something that you frame your decision-making around. That was my bet. That was my guess, my intuition. So that’s why I brought it up.

I should probably read that again.

It only came out in, I think, 2018. So it’s incredible.

Quitting isn’t bad.

All right. I have read Quit, her most recent one, and it was fine.

Yeah. What was the big takeaway from that?

The big takeaway was that quitting kind of our society, or just the world at large, makes quitting bad. She talked about how you must quit as a poker player, which means you must fold. Like most of the time, you just don’t; if you don’t have a good hand, then quit. So, she talks through many examples of when it was the right decision to quit. She goes from startups to big businesses to whatever. The thing that I remember, realistically, the book could have been like a long, like a podcast episode, is how it felt to me. I listened to it, you know, on audio, but it was one of those where I was like, yeah but I love that idea of quitting isn’t bad. Then the other aspect of it was to have kill criteria.

She’s like, kill criteria has a criteria and a date, or it has a, maybe a goal and a date. I forget exactly what she calls it, but it’s like if I don’t have x amount of revenue by this date, I’m going to shut the startup down, or I’m going to stop that marketing approach, or I’m going to stop this effort I, and get pretty concrete with it.

She said you can change that later if you get close to it and realize that stuff’s just starting to work. I think this has an asymmetric upside and will work over the next couple of months. You can always adjust it, but not enough people think that way is what she was talking about. So I thought it was a good one.

Product development is a funnel, not a tunnel. A good idea to start doesn’t always mean it should go all the way to completion.

Yeah, that’s awesome. I have a somewhat similar lesson or learning from one of my very earliest clients, from 1995 or ’96. When I started my agency, it was the Product Development Management Association (PDMA). The lesson, or the catchphrase, was that product development is not a tunnel but a funnel. I just thought that was genius because if you’re 90% of the way down the track with a product you’re creating, you probably want to finish it, right? But if the market is telling you it doesn’t want it anymore, or you have new intel that tells you that this is not going to go well because of a new competitor or some new something, you kill it even though you’re almost done. So it’s not a tunnel. Just because it entered the tunnel, it was a good enough idea to start the product development process doesn’t mean it should go all the way to completion. And I love that.

I think that’s really helpful. I think there are personalities that I see that start efforts. I’ll say companies, but it can be anything. And there are some folks who, at one extreme, just quit when it gets hard. I’ve been doing this for a week and am not a millionaire. I need to jump to the next idea.

I will launch 20 startups and see, and it’s like, “Come on, get it together.” On the other extreme, some folks will work on the same thing, grinding for six years, nights and weekends, with very little traction.

It’s like, “okay, we need a balance. We need some kill criteria here.” That’s where I think it’s either extreme or not helpful, but many people are like, “Well, how do I know when to quit? How do I know when to quit?” And it’s like, “Well, you’re never going to know.” It’s a hard decision, usually a permanent decision with incomplete information. You’re never going to know, but you’re going to have some data and take that data to your founder’s gut, take that data to the smart people around you, and take that data to you to sit with the decision.

This is what I often do. I had to kill a couple of things in the past couple of years, efforts that we were doing, and it took me several months to say, I think we’re going to stop doing these local events we were doing, but I’m not comfortable with that today. I’m going to just feel it and hold that for a few months and gather more data as I have conversations and as we run more of these events. Are these really worth it? The effort, blah, blah. And then, by the time I was two or three months in, I was like, we have to stop doing these.

I became convinced of that, and sometimes you do that, and you become less convinced of, like, “Yeah, I was off. We were going to rebrand.” We have two brands. We were going to combine them at one point, and that was a big decision. And then, over the next four or five months, it became obvious we should not.

So, that’s where you have to kind of listen. I don’t know what you are talking about; you said universal intelligence or something there. There’s a universe out there, and there’s also, you know, founder gut. I think that weighs in.

Yeah. Cool. I’m curious if you buy into the Kolbe assessment process because having kill criteria also presumes that somebody can enter and start something, and one of the Kolbe scores or criteria is being a quick start, and then you get a number associated with a quick start. I’m a nine. A quick start means I have many things to start, and I’m low in follow-through, so I need my team to follow me and clean up the mess.

So it’s good to know about yourself.

Yeah. And it’s great to know about all the team members that you work with and, you know, even your intimate partner, your kids, your parents, and everything. It’s cool. So, are you familiar with the Kolbe assessment?

Yeah, I believe. I was just trying to look to see if I have my PDF. I believe I’ve taken it, but I don’t remember it. I love personality tests like that for just learning about myself. So, the StrengthsFinder, Kolbe, Enneagram, and Myers-Briggs are slightly lower. But I’ve taken all of them, and I love reading through and saying, “Wow, that has me dead to rights.” And then other ones, it’s like, ‘I think.I don’t know. I think this one’s a little off.” We don’t give them to our employees.

A blind spot is just a weakness that you don’t admit or are unaware of.

I’m not super invested in it, but I definitely like and appreciate it, and I like that it has helped me realize what strengths are. What are my weaknesses? And to your point, how do you have a team around you, whether they work for you or, again, advisors, masterminds, or, you know, who’s supportive stuff? How do you have that team around you that can support you, and how do you know it’s fine to have weaknesses? It’s much, much more detrimental to have blind spots. A blind spot is just a weakness that you don’t admit or are unaware of. That’s the problem.

I can tell you three weaknesses that I have right now. That’s great because when I go to make decisions or do things, I feel that resistance because I’m like, this is you. This is your personality pulling away from bevel. I can have this inner self-talk of making the right decision. Not the decision that feels comfortable.

But if it’s a blind spot, it’s a weakness. I don’t know. Is there? I’m screwed. I will continue to make bad decisions over and over because I haven’t raised those to the top. I believe more in strengths. Like, I play to my strengths. I don’t try to improve my weaknesses, but I want to know what my weaknesses are so they aren’t blind spots.

Yeah. That’s great advice. It is also really important to make an astute observation or point out weaknesses versus blind spots. I love that. I’m curious about your Enneagram type.

Oh, my gosh. I need to look.

I’m Enneagram Nine, which is the peacemaker. I don’t know if that jogs your memory or anything. You’re probably not a nine because if you were, you’d say, “Oh, yeah, I’m a nine too.”

Yeah. I have my report. So my top is a three, which is the achiever, which totally sounds accurate. My second one is a type six, the loyalist, which describes me.

I have very few deep, deep relationships. And those relationships are deep in their lives. So, and then I’m a peacemaker. I’m a nine. That’s my third.

Yeah. How do you apply that or use it in your life to make things better?

The saying “hire slow, fire fast” is true—you’re doing them a disservice by keeping them in a job they aren’t excelling at.

Well, I know that I am. I am blind. I’ll tell you what. It’s not a blind spot, but it’s a weakness of I am too loyal. I can imagine. Let’s take a hypothetical situation where I have someone I’ve worked with for five or ten years, and they are really underperforming or really mismanaging things. I have a real tough time admitting to myself, like, this person needs to go. It’s like they’ve been loyal to me, so I should be loyal to them.

That’s not always the best course of action for you, your business, or even that person. That’s the thing that I’ve had to convince myself is, like, you’re doing them a disservice, keeping them around at a job that they’re not doing well at. So that’s where the loyalist is weak. The achiever is strong, by the way.

The adage of higher, slow fire fast, I think, is really true.

Oh, yeah. Big time. The achiever in me, the non-shadow. So the shadow side of that is that some people want to achieve to the detriment of everyone around them, right? They burn reputation and this and that. But, see, I’m a loyalist, so achiever with loyalists means I value humans and value relationships, and I want to get a bunch of stuff done.

So the achiever, I think, is without that, I don’t think that I launch that. I have built six companies. I don’t think that I start a venture fund. I don’t think that I write. I just finished my fifth book. None of that happens without the achiever. It makes me who I am today, and I don’t achieve. It’s not an achievement for achievement’s sake, but maybe some of it is at this point.

That’s cool. It’s so good to know who you are and how you’re wired so that you don’t go against the grain or try to swim upstream, and you just get into your unique ability, get into the flow, doing the things you’re really good at. Yeah.

Zone of genius.

Yep, yep. Zone of genius. Yeah. So you mentioned Myers-Briggs may be a little bit too. Do you remember what your Myers Briggs is?

Yes. It used to be E. Now I’m an I. I switched at a certain point, so I’m ISTJ. Is that right? Yeah. That means it’s all that. Every engineer is like an ISTJ, isn’t that right? Maybe the sensing. I think that’s it. It’s, like, very left-thinking and judging, for sure.

Yeah. So, I’m an INFP. So, I’m almost completely the opposite of you. My wife, INFP, is known as the healer. Yep. Which resonates with me.

Yep. My wife, we are opposites in that respect. And she’s very intuitive, and that’s when we work together. We just co-authored a book about selling companies from the psychology and the mental side of it of how difficult it is; our work styles and collaboration styles are so different because I am very much like the left brain achieve, like get into it, hammer it out. And she’s more intuitive with it. But man, she’s just so good at it. Our collaborations are just five times better than I could do on my own because she brings a whole other view to it as long as, I mean, sometimes you conflict with the opposites, right?

But if you can figure out how to realize that there are huge benefits to the other personality types and kind of integrate them, there are a lot of benefits there.

Yeah, it’s a great compliment. I mean, she’s a compliment to you, and it’s a compliment to her what you’re saying about her. She makes you better or brings out your best and gives you an awesome superpower and additional perspective and ability that she brings to the table. Yeah, good stuff. Also, you mentioned a StrengthsFinder. I’m a fan of StrengthsFinder. Do you remember your top strengths?

Let me look for it.

See, I could rattle them all off. I’m futuristic. Input strategic learner and ideation.

You and I have two. I’m a futuristic learner. Focus maximizer and achiever, which sounds right.

Yeah. Cool. So, how do you apply that learning or that kind of insight into your daily life and into the decisions that you make?

Yeah, see, the interesting thing is that I internalized the reason I don’t remember the numbers and the names, which is because I internalized this stuff. StrengthsFinder. Probably 15 or 20 years ago. I remember reading it on a commute when I still had a day job, and I realized that I live in the futuristic as I live in the future. I say that phrase all the time. I didn’t even realize I got it from here, but I will. It’s probably three times a week. I use that phrase with my therapist, with my wife, and with someone else.

I’ve always considered the future and realized it is a gift. There’s a reason. I started saving for retirement the day that I graduated from college. When I was 22, I started putting money away. And guess what? That has served me really well, but it’s also detrimental. Can you live in the moment? Can you experience the present moment without always thinking about the future? Whether daydreaming about it or thinking this is going to go wrong in the future. This could go wrong in the future. So I didn’t realize I had it, but the learner is just.

Oh, yeah, I’ve been doing that my whole life. I taught myself how to program. I taught myself how to be an entrepreneur.

As a little kid, I taught myself basic and assembly language; I was coding in hexadecimal before the Internet was a thing. Back in the eighties, I was teaching myself how to write a bulletin board system of EBS from scratch. And I did. I ran it from my home phone line.

That’s a learner for you. That was back when the information was so hard to get. I Speak BASIC to My Apple is the book that I got. I learned the basics from that. So, yeah, it’s funny. Achievers on both of these, right? On the Enneagram and here, which makes sense, it’s like I start companies, write books, and do all that. So it’s just like that. What do you call it? A reinforcing of. Like, I read that list. I’m like, maximize our focus. Yeah. Sounds about like me.

Yeah. Well, there’s one assessment I would recommend you add to your arsenal: the Demartini Values Determination. It’s free. You go to drdmartini.com. Dr. John Demartini. He was in the movie The Secret. He’s a polymath. He’s brilliant.

He’s amazing and really inspiring. A personal development expert, and so forth. Kind of like Tony Robbins, but not so rah-rah. It’s really inspiring to hear him. He’s been on my podcast multiple times. He’s been on this show. He’s been on my personal development show on Get Yourself Optimized.

So, if you go through the values determination process, you’ll get your hierarchy of values. Then, you can see how they stack up with your job duties, how you spend your time and your team when they take the assessment, and how that aligns their job duties and responsibilities with their highest values.

And if there’s a mismatch there, you have to move their job function around or what they’re doing during the day to match. Otherwise, you’re going to lose them.

Yeah, I like that. I just added it to my Trello board.

Yeah. Okay. I know we’re running short on time, so I want to talk about The SaaS Launchpad because you just launched that and utilized AI to help create this whole course. What did you do with the launchpad versus what you would have done manually back in the day when you were creating courses without AI? It was a night and day difference, right?

Yeah. Oh, big time. We probably saved ourselves. I don’t know if it’s 100 hours, but it’s some approximation of that. 50 hours, 100 hours. So the course I outlined, from all my experience, my knowledge, whatever, all the stuff I do and recorded it, all traditional, no AI involved, had editors, hand editing, did all that. We started thinking about AI because there are 28 videos in the course. It’s like a course, and it isn’t just videos.

You might say a course needs worksheets, quizzes, checklists augmenting, and secondary and supplemental material. And we realized, let’s just run one of these videos through Claude or ChatGPT and ask it to create, “Hey, what is a checklist based on this? And what is a summary? What is a quiz? What are some questions that you would want to ask?” Shockingly good, shockingly competent, and, you know, it takes two minutes, and it’s way better than really I would have spent time to do by myself. And I did. I launched. The last course I launched was like 14 years ago, I think, and I created all of this by hand, and it was just dozens and dozens of hours to produce material. That was fine. It was fine. But this is really high-quality stuff.

With our massive audience, we don’t need ads. We’ll raise six figures through an email, a YouTube video, and a podcast.

So, I continue. I truly don’t use AI in my day-to-day workflow. But it’s stuff like that and brainstorming because, you know, I’m writing a book every 18 months-ish right now. Even just coming up with book titles is hard. And I instantly go to ChatGPT, and I ask what book? Here’s the book, the text of the book, or the idea of it. Here are some titles I have in mind. Help me. And we just go back and forth and back and then subtitles and then, you know, jacket copy, like all that.

It at least gets me started.

Do you use the AI tools for the promotion and the planning for launches and things like that for the course, the books you write, etc.? Or is it just for the production?

Just for production at this point? Yeah, we have launched so many things that we have really nice project plans for all that I’ve done. I’m doing my second Kickstarter here in a month for the next book, Exit Strategy, which I wrote with my wife, and it’s my second Kickstarter. And we know what went well and what didn’t. Last time. And so, yeah, we have it. We have it all dialed in, I think.

So, how did you learn what to do and what not to do with a Kickstarter campaign?

We were going to hire a consultant, and we talked to many of them, but none seemed to fully understand what we were doing. We have a massive audience, and they kept saying, “Well, we’re going to run all these ads.” And it’s like, “We don’t need ads.” And then they were like, “I’m going to take 10% of your Kickstarter.” And it’s like, “We’re going to raise that. We’re going to raise six figures based on our existing audience. We will send an email, put a YouTube video, and do a podcast. You know, we have owned media. I’m not giving you 10% of that.” That’s insane. You know what I mean? Because you’re not earning anything. You’re just giving advice.

So, I really struggled with the Kickstarter consultants we eventually went to. We talked to three people who had run successful Kickstarter. A good friend runs a board game company and runs a Kickstarter every 60 days. Just got advice.

The more we pulled it in and started writing out, hey, this is what we’re going to do. It became obvious. It just wasn’t rocket science; it was just another launch. There are some nuances. You want to start on this day and end on this day. 40% comes on the first two days and the last two days, all the stuff that you kind of know, but there’s some tricks and tips, but there’s nothing magic about it. If you’ve launched things before, and I’ve launched a lot of companies, events, books. And so it just kind of, it was like, “Okay, it’s a twist on a launch.”

That’s cool. That’s cool. So he did some sort of synchronicity or intuition that told you, hey, do this as a Kickstarter instead of a traditional book launch because that’s unusual to do a book launch as a Kickstarter campaign.

Yeah, there’s only been a few. Usually, some fiction authors do book launches, but the only other successful nonfiction book I know is Eric Reese did something I think was called The Startup Way, or maybe I don’t remember what it was, but he’s the only other one. I wanted to do it because I’ve launched a ton of stuff over the past 20 years, and I’ve always done it with a landing page and an email. So, you know, traditional Internet marketing launch, the Kickstarter was a new thing, and I’m a learner, and I wanted to learn what that was like. I’ve also backed 300 projects on Kickstarter myself. I just love Kickstarter. So I wanted to see what it was like on the other side. I also wanted to do two launches.

This allows me to go to Kickstarter, do a whole launch, raise the kerfuffle, get the backers, and print hardcover books, which I’ve never done because you need a big order. You know, print those, and then three months later, those get here, and I launch again. That was super fun last time. So it was a risk. I didn’t know if it would work. And I. It’s certainly a public failure. If you don’t make it, it looks as bad.Right? But we did well.

We did $108,000 selling a book. I mean, it was in 20 days or something. So I was. I was pretty happy with it.

That’s cool. Good for you.

And I enjoyed it. Yeah. Thank you.

That’s fun. All right, well, we’re out of time, so if our listener wants to follow you, learn from you, sign up for your course, maybe even get investment from you, become part of your TinySeed. How do they get in touch? How do they follow you at all? That.

Yeah. If they listen to podcasts, they can go to startupsfortherestofus.com or search for that title in any podcaster or on YouTube if they are looking for it. If they’re SaaS founder, they can go to tinyseed.com. That’s the investment fund and accelerator we run. And if they want to learn about my books again, I’ve written four. I just finished the fifth. It hasn’t launched yet.

They can go to robwalling.com, just my full name, and get on the email list or just poke around there. I have a free book, one I give away for free. It’s called Start Marketing The Day You Start Coding. And so if you enter your email there, you can just download the book for free.

That’s awesome. Very generous of you. Okay, well, thank you, Rob, for the fun, enlightening and inspiring episode. And thank you, listener, for listening and being part of the community. We’ll catch you on the next episode. Have a great week. This is Stephan Spencer, your host, signing Off.

Important Links

Connect with Rob Walling

Apps and Tools

Books

Businesses/Organizations

Film

People

Previous Marketing Speak Episodes

Previous Get Yourself Optimized Episodes

YouTube Videos

Your Checklist of Actions to Take

Develop and rely on my intuition, often referred to as “founder gut,” which strengthens with experience. Entrepreneurship involves making decisions with incomplete information.

Check against my “kill criteria” to determine if it’s time to pivot or persevere. Knowing when to persist and when to adapt is crucial.

Surround myself with experienced advisors who can guide me through tough decisions. A strong network can greatly enhance my chances of success.

Bootstrap my startup. This approach helps me build robust skills and efficiency before considering funding.

Assess the market size, growth potential, and fit with my strengths before diving in. Success hinges on choosing the right market.

Regularly work on improving my skills and self-awareness. Use personality assessments to understand and leverage my strengths and weaknesses.

Whether in hiring or investing, prioritize honesty. Screen for genuine character traits to build a reliable and trustworthy team.

Treat my ventures as a series of high-quality bets. Understand that not all bets will pay off, but the majority of successful ones will lead to overall success.

Reflect on my experiences and learn from them. Recognize that struggles and challenges shape me, providing valuable lessons for future endeavors.

Engage with Rob Walling at robwalling.com and startupsfortherestofus.com and learn more about his content and community.

About Rob Walling

Rob Walling has started six companies, written four books about entrepreneurship, and invested in more than 190 startups. He’s helped tens of thousands of startup founders through his podcast, Startups for the Rest of Us, which has shipped an episode every week since 2010.

Rob Walling has started six companies, written four books about entrepreneurship, and invested in more than 190 startups. He’s helped tens of thousands of startup founders through his podcast, Startups for the Rest of Us, which has shipped an episode every week since 2010.

Leave a Reply