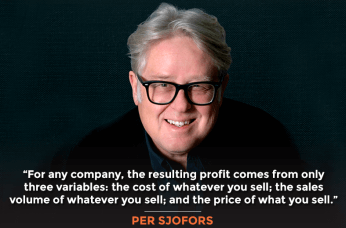

Many entrepreneurs face the complex question of how to price their product or service, and it’s a decision that can make or break a business. According to Per Sjöfors, AKA The Price Whisperer™, pricing is a profit and value lever. An increase in the price of a service or product by 1% can show a significant increase in profit.

Per is a thought-leader in everything pricing and how companies can use pricing to drive higher growth, sales volume, and profits. He is a sought-after speaker for various conferences, appears regularly on podcasts and business radio shows, and gets routinely quoted in the financial and business press.

Per developed an interest in understanding how the particularities of pricing fit into a company’s growth and margins and began experimenting in the companies he ran. Per discovered that business school teachings about pricing were too academic and theoretical. Pricing was discussed as a separate activity, completely detached and devoid of how it impacts the rest of a specific business when customer targeting, product and/or service features, marketing channels and messages, sales channels and methods, and price all interact together. Spurred on by this discovery, Per meticulously developed a process in which it is possible to use an original and proprietary online market research method that expertly predicts sales volumes at different prices for each aspect of a company’s operation.

In this episode, Per talks about how to price your product or service optimally. He also shares some of his clients’ success stories in repositioning and repricing their services and products. He also gave some feedback on my own company’s pricing strategy and what I need to do to raise my prices.

And now, on with the show!

In this Episode

- [00:19] – Stephan introduces his next guest, Per Sjofors, a thought-leader in everything pricing and how companies can use pricing to drive higher growth, sales volume, and profits.

- [02:13] – Stephan asks the origin story of Per’s interest to delve into pricing as his area of focus in his business life and also the importance of pricing in business growth.

- [06:50] – Per shares formulating pricing experiments to formulate and come up with a methodology that’s based on a very different kind of online market research.

- [08:48] – Stephan wants to know the ways to avoid ticking off one person who paid a higher price when they find out that there’s a lower price if they came through a different channel.

- [10:37] – Per tells an example of successful repositioning and repricing.

- [14:37] – Per talks about getting ROI for his clients between 2-4 weeks, even for small companies.

- [16:59] – Stephan and Per discuss prices for audits and monthly retainers.

- [20:59] – Stephan shares having great successes with some low-figure businesses, growing them, and getting them really great results.

- [28:20] – Per talks about the proprietary methodology that he came up with on how to calculate optimal revenue and profit pricing points without having to go to market with these different prices first.

- [29:34] – Stephan shares with Per the experiment that he tried last year and wants to hear Per’s thoughts on it.

- [33:14] – Per communicates completing the Masterclass on pricing which provides detailed and practical insights into pricing.

- [34:15] – Stephan asks how Per charges for the bigger engagements and whether it is on a monthly retainer or project-based.

- [36:36] – Per shares his thoughts about inflation and the importance of raising your prices to avoid degrading the service that you provide.

- [41:11] – Check out Per Sjofor’s’ website to learn more about his services. Also, follow Per on LinkedIn for his regular pricing tip and check out his articles on Medium.

Transcript

Per, it’s so great to have you on the show.

Yes. I’m delighted to be here. Thank you very much for that introduction. Obviously, your show is called Marketing Speak. One of the four P’s of marketing, obviously, is pricing. It’s often the forgotten P, to be honest.

I’m excited that we’re going to delve into that because there is an art and a science to pricing products and services in a most effective and optimal way. We’re going to learn all about that in this episode.

First, I’d love to start with your origin story a bit of what got you so excited to delve into pricing as your area of focus in your business life. Also, why should our listeners care about pricing? Because it is essential to a business’s growth to get pricing right. Let’s start there.

Let me start with the second topic. It’s very interesting actually. For any company, the resulting profit comes from only three variables. It comes from the cost of whatever you sell, the sales volume of whatever you sell, and the price of what you sell. If you do a simple calculation, you will find that of these three, pricing affects profitability the most.

Why is this so important? Because it’s profit that drives your company.

In fact, doing sort of a thought experiment—and I’ve looked at this on oodles companies—for the average company, if you’re able to increase your sales volume with 1%, your profit, again, for the average company will go up 3.5%. If you’re able to reduce your cost with 1%, profitability will go up 5.5%. But if you’re able to increase your price with 1% or reduce your discount with 1%, profitability will go up 11.3%.

Why is this so important? Because it’s profit that drives your company. It is profit that gives you the resource to market more, to develop more products or define more services. It is profit that drives shareholder value.

I have a little challenge to the listeners and I call it the 1% challenge. This is, have you ever failed to change something 1%? Of course not. It is so tiny that when you start looking at this from a pricing perspective, you’re looking at increasing your prices with 5%, or 10%, or reducing your discount with 5% or 10%. It will increase your profits spectacularly and give you the resources to become even more competitive. That is the power of pricing.

One more thing that is interesting. In a research project we did a couple of years ago, we asked a few hundred American CEOs the question, which of these three variables affect your profitability and the value of your company the most? And 82% said more sales, which is crazy.

It’s also interesting that we looked at the 12%, I think it was, that says pricing. Those turned out to be the market leaders in their industry. Those are companies who really understand the value here of using pricing as a profit lever and as a value lever. That’s the answer to the first question.

The second question is, how did I get into this? What happened is that I ran a couple of companies in Europe before I got here to the States. I came here to establish and run a division of a fairly large public company. Then I’ve been running a few other companies after that.

In these companies, we did experiments with pricing. Some of those experiments were tremendously successful, like next quarter revenues are up 25%. Others were complete duds, and many were sort of inconclusive. What I had learned in business schooling and read about pricing was so academic and so theoretical that it was completely useless information. It didn’t help us at all to understand why some of those experiments worked and others didn’t.

I decided to develop a process to make every pricing experiment a success.

Fourteen years ago, when I decided that I was too old and too opinionated to be a hired gun, I set up my own company. I decided to develop a process that will make every pricing experiment a success. That is the process that we are still using.

And the pricing experiments that you conduct, they’re on behalf of clients, or they’re part of original research projects, or both. How do you formulate these? How do you come up with the hypotheses?

In the companies I ran, it was just experiments. We tried this pricing, we tried that pricing and so forth. What we do for our clients in our company—and this is the basics of the work we do—is that we have a methodology that’s based on a very different kind of online market research, very different than what you would get from a market research company. In that, we can accurately predict sales volume at different prices and revenue at different prices.

That’s just the very first step because then, we correlate that prediction with different customer profiles of our clients. We can advise our client to focus on this profile because it’s going to lead to the highest sales volume and the highest revenue. Then we do the same thing with features, functions, and benefits of a product or service. We tell them to focus on these features, functions, and benefits because it’s going to lead to the highest sales and the highest revenue.

The same with marketing. We tell them these are the marketing channels and these are the marketing messages that’s going to be most effective in driving sales and driving revenue. The same with sales, what sales channels are most effective, what sales messages and methodologies are most effective.

In the end, obviously, we recommend the pricing strategy that will minimize friction and maximize sales and revenue. It’s really a complete go-to market strategy based on hard data and based on leveraging or understanding what is the most effective in driving sales and revenue.

Do you change the pricing based on the marketing or sales channel that you’re selecting so that you give different pricing to different constituents through different channels?

Yes.

How do you avoid ticking off one person who paid a higher price when they find out that there’s a lower price if they came through a different channel?

You can’t just change the price. You need to position the product or the service differently or you may need to have a different set of features and functions. Most may be the same, but not all of them. There need to be differentiators. That brings me to another thing because especially when you look at commodities or near commodities, the trick here is to find differentiators that are meaningful for the constituency of buyers.

Let me give you an example of that. About a year and a half ago, we worked with a company here in Southern California who rents out these steel plates that you drive over when there’s a trench in the street. If you can imagine something more commoditized than a piece of steel, but it’s a piece of steel.

This company differentiated itself in meaningful ways by providing training services. They trained the buyers and the workers that are on site digging those trenches and so forth on safety, and a few other things. Because of that, the company was seen as the thought leader in the industry. Not only could they command about 25% higher prices than competition, they also had about a 65% market share in their market and become a very, very profitable company selling a commodity.

That’s a great example. What about, let’s say, a marketing consultant or consultancy? What sort of example do you have to share of successful repositioning and repricing?

Every company talks to its customers. Not only do every company talk to its customers, every company also goes to market with a certain value proposition and a certain marketing. That marketing attracts a certain number of clients.

The problem is that when a company only talks to its clients, it gets a skewed view of the market because only those who accept the clients’ marketing messages and value proposition become actual customers. If you ask them why they bought and what they were looking for, and all the normal stuff, you’re talking in an echo chamber. You hear back the reasons that you used to market.

Selling to a different constituency within these large companies who buy these expensive websites would significantly increase that company’s market reach.

As an example, we did a project for a fairly large digital agency that is building these very comprehensive websites. When we’re talking websites, websites that they charge between a quarter of a million to a million dollars for. What we found was that their customers echoed back the value proposition that the company had. But in fact, there was a completely different set of customers for which different value messages and different marketing messages were important. Also selling to a different constituency within these large companies who buy these expensive websites would significantly increase that company’s market reach.

They had a situation where they went to market with a value proposition, they hear that same value proposition echoing back, and they were missing out on actually a much larger market that was attracted by other marketing messages, other positioning statements, and that lead actually to a higher willingness to pay than what the company had.

That’s a great example. I’d love to hear what the original positioning was and what that positioning was changed to after your research.

The original message was very technical. They attracted buyers for the technical piece of the website, what you do on the website, and all different technical things. We did the research, but I don’t have any insights of what these technical details mean.

The larger markets were much more interested in the resulting benefits. The company essentially had to change the way they went to market. I know from the CEO that this has been very, very successful and suddenly they don’t have pushback to their fairly expensive prices for these websites anymore.

An example of that might be switching from a focus on things like PageSpeed and technical details of the website infrastructure, architecture, to things like, we found a 3% or 5% increase in customer retention or in average order value after we redesigned our clients websites across the board on average, or something like that.

Exactly. This is, again, a fairly large agency with 150 people or something like that. The marketing people were very influenced by their technical people in how they did the marketing. PageSpeed, what’s the benefit of that? The benefit is that you have a lower bounce rate. It made a big difference for the company.

For any company, the resulting profit comes from only three variables: the cost of whatever you sell; the sales volume of whatever you sell; and the price of what you sell. Share on XThat’s awesome. What sort of ROI do you typically get for your clients? They spend whatever X amount of money with you. Did they get a 5X, or 10X, or 100X ROI working with you?

ROI in time is typically between 2–4 weeks, even for fairly small companies.

So you’re saying is in 2–4 weeks, they will get their money back in increased profit from the expenses of hiring you?

Yes. Let me tell you another story here. This is unusual, so don’t think that this is going to work for everybody. An LA-based company here got a phone system in the cloud. We discovered that they were way underpriced. It’s so underpriced, in fact, that they could quadruple their prices.

If you go to a market with too low prices, the price itself always sets an expectation of the quality and benefit that your product or service has. If you have a too low price, people won’t buy it because they don’t think it’s any good. We all have been there. We look at the price of something we want to buy and then we say, no, I don’t think so. This is too cheap.

What I’ve seen on my Facebook feed lately is a company who promotes selling Apple Macs for $89, brand new Macs. For me, it must be a scam. Or in the end, maybe when you put your credit card details there, there’s going to be a $1500 delivery fee or something like that.

This particular company, they were way underpriced. They followed our advice and they quadrupled their prices, not in one go but over a time period of six or seven months. Two things happened. First off, their sales volume increased with about 25%, and then they got a completely different set of customers.

Using the technical term that the CEO used when he told me this, he said, “We got rid of the bottom feeders and now we have a more professional level of customers.” Because of that, our customer support costs have gone down with 80%. Isn’t that amazing just by changing the price?

I’d love to give you my pricing and have you tear it apart live here on the show because I’m sure I’m not doing it in the most optimal way. I haven’t raised my prices for audits, monthly retainers and so forth for a decade.

“We got rid of the bottom feeders, and now we have a more professional level of customers.”

Oh, wow.

The prices are high, so I am at the top end of the market. But you get to work with me, so I think that’s worth it. We tried an experiment last year. I’ll fill you in on that in a minute. But $35,000 for an SEO audit, it’s expensive. That’s an expensive audit.

Keyword strategy, $15,000–$20,000, depending on the scope of it. Link building strategy, $20,000–$25,000 depending on the scope. Other major deliverables, ala carte, in that kind of price range. They’re significant deliverables. They take many weeks to produce. This is not just a hit a button and the report comes out.

If they’re working with us on an ongoing basis, there’s a month retainer, $15,000 is the minimum. It’s usually a three- or four-month minimum length of engagement and then month-to-month after that. My question to you is in that kind of pricing model, without raising our prices in 10 years, where can we go? Can we quadruple our prices? I don’t think so.

I don’t think so, either.

I think there’s a way to reprice so that it’s a win-win. I don’t know what the secret to that is. Do we break up the audit into three audits? We’ve tried that as well. There’s the link audit, technical SEO audit, and a content audit, and then price those separately like $15,000 each. If you buy all three, then it’s $35,000 instead of $45,000. We’ve experimented with that. I’m curious to hear what your thoughts are on this.

First of all, what is the result of these experiments?

Profit gives you the resources to market more and develop more products or define more services. It is profit that drives shareholder value. Share on XWe don’t sell very many $35,000 audits. I don’t have statistically positioned it as three audits that you could pay or all three for a combination of, essentially, a $10,000 discount. I don’t have statistically significant data on that. I just don’t have enough sales.

We’re a significant-sized business. We’re still not able to give you meaningful data. Anecdotally, I think it’s a good way to go. That’s the feeling. That’s a gut reaction instead of based on hard data.

Two reactions. First off, yes, you’re at the top of the market, obviously. The other is that, a knowledge that was very unique 10–15 years ago, is not so unique anymore. This has been much more commoditized and so forth. What that leads to is really a loss of pricing power.

There are two things that I’m thinking of. First off, it’s all about customer targeting. I assume that what you do is your customers are the typical Fortune 2000s or large companies. Obviously, that’s where you need to continue to focus with those prices.

It’s all about customer targeting.

That said, I have had some great successes with some low-figure businesses, growing them, and getting them really great results. Even a low six-figure business has been with me for five years now. They’ve really grown. They’re seven figures now and a million unique visitors a month. That’s a great success story.

Yes, but you’re also saying that you sell quite a few of these. I assume that they’re pretty profitable.

Very profitable, but also high results or rewards for the client. One example is macsales.com. Speaking of selling, Apple Macs just a few minutes ago. They sell hard drives and memory for Macs so that you can replace those components and not have to buy a brand new machine every two years.

We got them after an audit within two months. I can’t give real specific numbers here, but multiple millions. That’s a pretty good ROI on an audit that, actually, they didn’t pay for directly. I donate an SEO audit every year to an Impact Network, nonprofit, that builds and operates schools in Zambia. I’m on their board. I donate an audit that I’ll do the full $35,000 audit. I won’t receive a penny for it.

That offer goes up on the charity buzz website. There’s an auction with 100% of the proceeds going to the charity. I’ve been doing that for a few years now, like four years. Pretty much every time, except maybe once, they turned into my clients, which is amazing.

I definitely believe in business karma, but that wasn’t the whole angle that I was coming. I just purely wanted to give. It’s like $15,000–$20,000. You could build a school in rural Zambia. That’s a big impact for not a lot of money.

Anyway, I don’t see it as an audit. I didn’t receive anything. I don’t really know what macsales.com paid for that audit, but it was a five-figure sum and several million dollars in revenue within a couple of months. An additional revenue that couldn’t be attributed to any other activities other than implementing the SEO audit, so that’s pretty awesome.

Yeah, it is, and for a good cause, so it’s a win-win-win here. Again, to defend those high prices that you have, it is customer targeting, though. That means in your case, size of company, industry, how they sell and so forth. Even the title of the buyer, the title of the influencers in the company, and so forth. Understanding how all of that impacts what they’re willing to pay.

Just like I mentioned with this little case study, also, what marketing messages you use. Yes, you can obviously do a lot of testing. The problem with testing is that, let’s say, you want to test five different marketing messages, five different positioning statements, five different customer profiles, and then five different prices. Suddenly you have five times five times five times five times five times five, what is that? It’s a couple of hundred.

You want to test all these combinations and that takes a very long time. Not only does it take a long time, if you have returning customers, and if the audience have returning customers, and see every changing prices and every changing messages, they get confused. If you get confused, you’re not going to buy.

The methodology I developed will tell you all of this in one goal.

The methodology that I developed will tell you all of this in one goal. There is very little need for testing. There’s one thing on your prices here that is worthwhile considering. There is something called price walls. Price walls are psychological price points where small price changes generate a significant change in sales volume and revenue.

To illustrate that, let me give you an example. I spent some time with one of the VPs at HP just before the pandemic here. One of the things he told me was that they had done some testing with one of their computer models. They sort of inched up the price $1 at a time as they were carefully looking at the sales volume. They could go up $17 without any change in volume, whatsoever. But if they went up to $18, sales just fell through the floor.

That meant two things. First off, they had found one of these price walls, but it also meant that they had been leaving $17 on the table. That makes a difference when you’re selling 10,000 of this computer a day and it’s a low-margin product. Knowing where these price walls are is really crucial. While the price walls are often at prices, we can think of $100, $1000, $10,000, and so forth.

$35,000.

No. I can assure you that $35,000 is not by a price wall. There’s probably going to be a price wall at $25,000. There’s probably going to be a price wall at $50,000. What you’re selling is something very unique and already quite expensive. It may well be, if nothing else because you haven’t increased your prices for 10 years, that you can go up to just below that price wall that’s going to be at $50,000.

Without doing the work that we do in my company, you will not know how severe those price walls are. You may know where they are, but you don’t know how severe it is. It may be that you cross one of these price walls and your sales volume goes down with 2%. It may also be that you cross one of these price walls and your sales volume goes down with 40%. The other thing is that because we can model sales volume at different prices and revenue at different prices, the company or clients can really make that trade-off between volume, revenue, and profit.

If you go to a market with too low prices, the price always sets an expectation of the quality and benefit of your product or service. Share on XSometimes you really want to focus on volume because you want to take advantage of the network effect and grow your market share, and stuff like that. Other times, you want to focus on revenue at a lower sales volume, which then is going to have a lower cost of goods sold. Or if you’re selling digital service, there’s going to be less customer support, less sales costs involved, and so forth. So it’s going to be a more profitable price. Or you may want to find the price that is in between on the right side of a price wall that has a high sales volume, but also high revenue. Once you have this data, setting the right price takes 30 seconds.

Yup. You have some proprietary methodology that you came up with on how to calculate these optimal revenue and profit pricing points without having to go to market with these different prices first.

Correct. We have a proprietary way of doing market research. The data that we collect from the market is being analyzed by a piece of AI software that we have developed. From that piece of software, we get the advice, but this is very technical advice. Then I have business people looking at those advice or the data that comes out of the software. It really makes humanly understandable practical advice.

Focus on this customer profile, and use these features and functions in your sales and marketing.

We tell our customers, again, focus on this customer profile, use these features and functions in your sales and marketing. If you haven’t developed them yet, why don’t develop those that lead to the highest sales and revenue, and use these marketing channels, these marketing messages, and so forth? It really becomes a hard database go-to market strategy for any company that wants to take itself to the next level.

I want to share with you now the experiment that we tried last year and I want to hear your thoughts on it. I brought in a COO who thought that our prices were too high. When you look at the competition in the marketplace, we’re at a premium price. He pitched me on reducing the price significantly but removing my involvement in those engagements, which I thought was worth a try because I can’t scale this agency much higher with my personal involvement in every single engagement.

I have the same issue.

A few pricing tiers. One without my involvement and one with. Our margins got absolutely destroyed. We have clients still on those lower pricing tiers, hopefully retainers. I can’t just jack up the price on them. They probably can’t afford it. It just feels like pulling the rug out from under them.

What are your thoughts on that experiment? First of all, it was more than an experiment. It was kind of an all-in sort of strategy. What do you think about the results that we received?

I assume that the COO is no longer with your company.

That’s correct.

What he or she did was that he forgot one of the most important things and that is understanding the reason why people buy from you and how to defend higher prices. You suddenly attracted a different kind of customer. Just like in the example with that phone system in the cloud, you attracted customers who don’t care about your involvement. For that reason, they have a lower willingness to pay and that’s why they bought the cheaper price.

As cost increases, you cannot any longer assume your cost. You have to raise your prices because otherwise, you have to degrade the service or product you provide. Share on XBut you, in the end, are the biggest differentiator and the biggest reason why you have pricing power. He took away that pricing power and suddenly you became more of a commodity. Because of that, he destroyed your whole value proposition.

What you should do with these lower margin customers is that you should start increasing your prices, maybe by 5% every six months. I can tell you that they probably won’t notice. But as you go over time, this is going to make a difference. Certainly, if you can prove to them the result you have done even at the lower price, you are going to see margins increasing on those clients.

There’s a method of increasing prices and it’s all about messaging and so forth. I’ve written a little guide to how you can increase prices successfully. It’s not rocket science, but it’s a method. Most companies who increase prices simply just do it on a whim. That’s often a recipe for a disaster or something.

Is this guide on Amazon? Is it a free download?

Most companies who increase prices simply just do it on a whim. That’s often a recipe for a disaster.

There’s an audio version of it on Amazon and I updated it. It’s really available on my company’s website.

Awesome. So it’s a paid document?

No, it’s free.

All right. That sounds like a really great piece of content. Awesome.

There’s more, actually. I just recently completed the master class on pricing. That’s also something that is paid for. That’s also available on the website. It’s 19 video episodes, each of them being between 10–15 minutes. It’s about 4 ½ hours of content. What we talked about here today is just scratching the surface. There’s so much more that you want to know when it comes to real pricing.

I’ve got to ask, how did you come up with the price for this online course and what is that price?

The price for the online course is $950. What I did not only for this, but also for our own services, we’ve eaten our own dog food. We’ve done the research to find out what our customers are willing to pay for the stuff that we do. We understood the marketing messages and so forth that drives the highest sales volume and the highest willingness to pay. We’re eating our own dog food.

How do you charge for the bigger engagements? Is it on a monthly retainer? Is it project-based?

It’s project-based. It’s in the tens of thousands. I’ll tell you what. I have so many startups that come to us. They say that we’re going to launch this product, we’re going to launch this service, and I really need to know what price I should charge. They can’t afford us. At the same time, I want to help people. I want to help entrepreneurs.

I’m presenting for entrepreneurial programs all over the place all the time. One of the reasons I did this course was that for a much more affordable price, they can teach themselves and at least get the basics right.

On that note, let me tell you the most common mistake I have seen entrepreneurial companies do when they launch. They come up with some kind of innovative product or service. When you have something innovative, something disruptive, you’re only going to appeal to early adopters. The problem with early adopters is that there are only a few of them. They buy for all different reasons, but low price is not one of the reasons.

Price walls are psychological price points where small price changes generate a significant change in sales volume and revenue. Share on XWhat happens here often is that these entrepreneurs go to market. They struggle for a year or so, then they look at what they promised the investors and the money they still have in the bank, and they panic. What happens after that panic is that they lower their prices. They lower their prices in an attempt to sell more, but what then will happen is that they may even sell less. They certainly are not going to sell more. They can’t increase their prices again.

Instead of being that change that will elevate the company, it will be the change that actually kills the company. They kill themselves because these early adopters, the very few of them, are often willing to pay very high prices.

What do you do about inflation? Because if you keep the price the same, your dollar erodes along with everybody else’s as inflation kicks in. The inflation rate is (I think) under-reported and they’re trying to brush some things under the rug. Practically speaking, it’s a lot higher. What are your thoughts?

I think so too, at least, based on what I’m paying. You need to raise your prices, that’s how simple it is. You need to have that process of raising prices. You need to find the fence that makes sense to your client to raise prices.

You have to raise your prices because otherwise, you have to degrade your service.

One of the things that you want to message when you raise prices is simply that, just like in your case, you held your prices for a very long time. As cost increases, you cannot any longer assume your cost. You have to raise your prices, because otherwise, you have to degrade the service that you provide.

That sort of leads to another issue and that is price wars. If you think about who’s the winner in the price war, the answer is nobody. That is because if you’re in the price war, eventually, the companies that are involved in that price war have to degrade their product or service to the point that it doesn’t leave any value to the customer anymore.

That’s a race to the bottom.

Exactly. As an example, think about this donut shop that was in the price war and they had to reduce their cost. What is the cost? The amount of dough used in the donuts. Eventually, they reduced the cost so much so that the donut disappeared. They make the hole bigger, and bigger, and bigger and then you don’t have a product anymore.

Obviously, we can see that in the airline industry. I’m an old fart and I know how it used to be to fly. Compared to today, it was a pretty comfortable experience.

That was really good old days.

Yeah, and that’s because they’re in this price war. Every American airline, except Southwest, has gone through bankruptcy in the last 15 years. Everyone. Most of them, as a result, disappeared. Some of them have been bought in bankruptcy by other airlines, but 9 out of 10 or 8 out of 10 have simply folded. That, of course, means less competition for us, and loss of jobs, and all different bad things.

All right, last question here before we wrap up. What are your thoughts about RFM—recency, frequency, and monetary value? I haven’t heard that acronym for a while now.

I’ve never heard of it.

Okay, you’ve never heard of it. That’s good. It’s really not relevant today or maybe never was. Okay, great. Quick answer to that. All right.

Where do our listeners or viewers go to learn more? Obviously your website for the online course and the free download, but what can they expect from an initial outreach to you to maybe hire you till you give them a strategy call?

Valuation should be on the mindset of every founder of a company.

I have to tell you this. The results that we give our clients leads to a hockey stick of sales and revenue. That, by itself, leads to a much higher company valuation. At the moment, I’m getting a good portion, more than half of my business, from private equity groups. What that really means is that private equity group that controls portfolio companies. Every so often, I get an email from somebody’s CEO and he or she tells me that I have been told we should talk. Valuation should be on the mindset of every founder of a company.

You can obviously follow me on LinkedIn. I post little pricing tips every day on LinkedIn and things that you should think about as you do your pricing, as you think about your pricing. I have a whole bunch of articles on Medium and on other sources. I am interviewed quite frequently, like this interview. There’s a link on that, it’s also on the website.

There’s a wealth of information online that you can get.

There’s absolutely a wealth of information.

That’s awesome. And the best place to start is your website, which is?

It’s my last name, sjofors.com.

Perfect. All right. Thank you, Per. This was fabulous and inspiring. I’m going to make some pricing changes. Thank you so much.

You also need to tell me how it went. To be honest, if you want to have an offline conversation, we can talk a little bit in detail.

Thank you. Listeners, this guy is legit. If you need some pricing help, he’s the go-to guy. We’ll catch you in the next episode. I’m your host, Stephan Spencer, signing off.

Important Links

Connect with Per Sjofors

App and Tool

Businesses/Organizations

Your Checklist of Actions to Take

About Per Sjofors

Per is a thought-leader in everything pricing and how companies can use pricing to drive higher growth, sales volume, and profits. He is a sought-after speaker for various conferences, appears regularly on podcasts and business radio shows, and gets routinely quoted in the financial and business press.

Leave a Reply